Platform Lendingblock - a breakthrough in cryptrading

Lendingblock Is an exchange where users can borrow, take cryptocurrency, digital assets at interest in the most convenient and secure way. Large and small lenders, borrowers cooperate on the basis of credit agreements.

Lendingblock Is an exchange where users can borrow, take cryptocurrency, digital assets at interest in the most convenient and secure way. Large and small lenders, borrowers cooperate on the basis of credit agreements.

On the Lendingblock platform, lenders can earn income for investments made in different digital assets. Borrowers, in turn, can use assets as collateral to maintain hedging and short-term operations.

The key objective of the Lendingblock project - stimulating lending in the crypto-financial system. Through this, the Blockchain economy will benefit from the proliferation of such loans. By developing this project, the need for ineffective intermediaries will be minimized. All processes on the Lendingblock platform are carried out on the basis of Blockchain. This ensures security, transparency and automation of all transactions.

Key features of the Lendingblock platform

Service Lendingblock features the following features:

- transparency, simplicity of operations: creditors, borrowers can not doubt the security of ongoing transactions;

- abundance of assets (digital): organizations, individuals, creditors can absolutely safely, quickly make a profit from investing funds;

- maximum protection of transactions: extended, deep protection, simple collateral protects all users (borrowers and active creditors);

- the ability to borrow digital assets: borrowers, as well as market makers, investors can access the proposed assets for effective trade, working capital, and more active business financing. This is a useful opportunity if you need to get additional funds.

Key principles of Lendingblock service

The following principles can be singled out, according to which the Lendingblock platform operates:

- security: developers are confident that the data of participants, their assets are reliably protected from possible harm;

- secrecy of data: the structure of the platform guarantees absolute security, safety of user data;

- transparency: the architecture ensures that the cooperation of participants, transactions are available for viewing;

- scalability: all guarantees regarding the performance of ongoing transactions from the administration of the resource are being met.

Processes conducted on the Lendingblock platform

The borrower for conducting operations must pass 5 following stages:

- initiation: at this stage the borrower searches for a suitable lender using smart contracts;

- registration: the user creates an entry, after which he needs to go through the verification of personal data;

- Specification: the borrower shows a list of details (with a listing of loan objectives). At the same time, the pledged property is transferred;

- service: the borrower carries out payments extended to the creditors in accordance with a clever contract. The value of the collateral is adjusted if necessary. This is necessary to reflect all possible changes in price;

- completion: the borrower pays for the loan, the amount is immediately returned to the lender. After that, the borrower is returned a pledge (provided all the terms of the contract are fulfilled).

Steps of creditors

To start working on the Lendingblock platform, the lender needs to do the following:

- register: in the process, the borrower creates a separate account. Then the reliability of the personality is assessed;

- pass the specification: the lender specifies how much he can provide, for how long (in the process of filling in the profile);

- conduct an operation when the creditor receives payments (interest) by means of smart contracts;

- to check the end of the transaction: if the obligations are not realized, the borrower is given a pledge for the recoupment of investments. When all the requirements of the parties are fulfilled, there are no problems with conducting transactions.

The main users of the Lendingblock service

Lendingblock service offers owners of digital assets to receive large cash incomes. The end users of the platform are representatives of organizations, companies that wish to borrow or, conversely, provide cryptocurrency assets. These entities can be retail or institutional and fall into two categories - lenders and borrowers.

Lenders using the Lendingblock platform are hedge funds, as well as representatives of organizations, managers. They will be able to access all the possibilities of modern lending. These participants can receive regular interest income from the portfolio of assets. At the same time, there is no need to sacrifice long-term prospects for property.

Borrowers are key users of the existing lending industry (investment managers, hedge funds, private traders). These users use the tools provided by other members to achieve all sorts of goals. The choice of the most suitable creditors and debtors is carried out simply - in a few clicks.

Guarantee of safety of digital assets on Lendingblock

Lendingblock specialists work closely with experienced lawyers. This is necessary for the platform to operate within a legal framework. Accordingly, users of Lendingblock can provide funds to other participants (without exposing them to risk), and also use digital assets. The established legal principles concern the process of lending, collateral, as well as legal advice, the use of intellectual contracts. In the process of active work on the platform Lendingblock users will be able to evaluate the following benefits:

- granting the possibility of issuing a crypto-loan;

- registration of the necessary legal documentation on the conducted transactions;

- if a dispute arose, specialists come to the aid of the parties and help to fairly resolve it.

LND token description

The LND token is issued in accordance with the norm of ERC-20. It is used as the main element for making calculations within the system. Interest payments on loans that are paid to borrowers are made in the LND crypto currency.

To conduct ICO Lendingblock released 1,000,000,000 tokens LND (no emission). All the tokens that will not be sold will be destroyed. For sale, it is planned to use 60% of the total amount of released tokens.

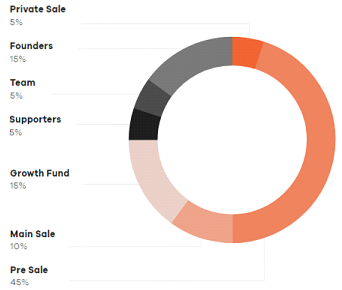

Distribution of tokens

45% - pre-sale

15% - development fund

15% - for founders

10% - main sale

5% - private sale

5% - supporters

5% - for the team

Team

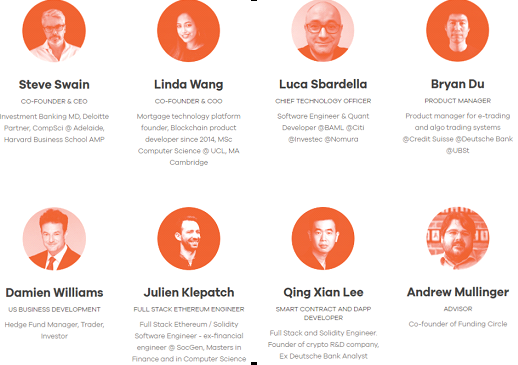

Steve Swain - Co-founder

Linda Wang - Platform Founder

Luca Sbardella - Technical Director

Brian Doo - Product Distribution Manager

Damien Williams - US Business Development Specialist

Julien Kleppatch - financial engineer

Andrew Mullinger - Chief Counsel

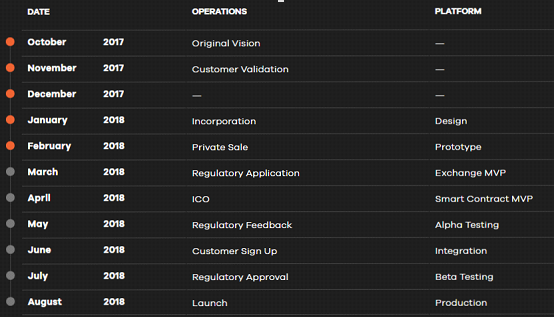

Roadmap

In January of the year 2018, the main operations became available to users. In the same period, experts completed work on the design of the Lendingblock platform. In February 2018, a closed sale of LND tokens took place. In March, experts launched a regulatory application, implemented in the Exchange MVP platform. For April 2018, ICO is scheduled to be held, a smart MVP contract will be implemented. In May, feedback will be established to check regulatory requirements. In the same period, the alpha testing of the Lendingblock platform will be conducted.

Priority service audience Lendingblock - institutional players. This has a positive effect on the scale of the project. The platform is designed to work with a wide range of assets that can be used for lending and creating collateral.

ANN Thread: https://bitcointalk.org/index.php?topic=3109951.20

Website: https://lendingblock.com/

Whitepaper: https://lendingblock.com/static/media/Whitepaper-English.21b2ed91.pdf

Facebook: https://www.facebook.com/lendingblock

Twitter: https://twitter.com/lendingblock

Telegram: https://t.me/lendingblock

LinkedIn: http://catcut.net/IPls

Reddit: https://www.reddit.com/r/Lendingblock/

* Our BTT account - https://bitcointalk.org/index.php?action=profile;u=1473358;sa=summa

March 20, 2018