How to Trade in Crypto-Currency: Basics and Trading Strategies

Outside XXI Century, humanity does not stop in its development and seeks to turn the planet upside down in its progress. Earlier, earning money was a heavy physical labor, today you can become a millionaire, just sitting on the couch is truly a magical time for achieving global goals. One of such opportunities, from scratch to break into the list of Forbes, is cryptotrading. What is it, how to make money on it and what profit can you get - everything in this article.

What is trading crypto?

In a recent blog post, we already talked about What is the crypto currency And where it came from. This phenomenon can be called a real revolution and today only the lazy do not try to earn it. Therefore, it is not surprising that digital money has become the subject of speculation - they can be very quickly and earn a lot. And if you think that trading on the stock exchange is a matter for very rich and economically brilliant people, then you are very wrong - anyone can become a trader.

The origins of trading crypts take from the appearance of the first crypto-instruments, but primarily it was more like a simple exchange. When, however, the audience of investors willing to invest in coins began to increase in geometric progression, then the real hype around crypto-exchange exchanges began already. Everyone realized that it's really possible to earn money, this is not a divorce or a financial pyramid, but because kryptornok was filled with billions of dollars of investment.

Where to trade crypto currency?

The most important thing for the future trader is to choose the right trading platform. ABOUT CURRENCY EXCHANGE CURRENCY There is a separate article and you can consider specific examples in it, but nevertheless, the choice of the site depends not on what it is beautiful, but on your goals.

- If you do not want to deal with little-known crypto-currencies, then you do not need big exchanges - you'll just get confused in their functionality and a lot of coins. To trade the main crypto-currencies with long-term prospects it is worth choosing Bithumb or Kraken.

- For traders who want to conduct operations between the Fiat and the crypt, Exmo, Livecoin and Bitfinex are perfect.

- A large number of currency pairs are represented on YoBit, Bittrex, Poloniex. If you understand the value in unfamiliar public coins and are ready to take risks for the sake of good profits, then such exchanges with a large assortment will suit you as well as possible.

Cryptocurrency exchanges today have divorced visibly and invisibly and it will not be difficult to choose a platform for your goals. Any whim for your money: if you want a Russian-language one, with a minimum commission, without verification - you can find an exchange for every taste and color. But in this search, do not forget that the greater the daily turnover of the site, the more lively the trades are, and this parameter must be looked at in any case. And, of course, remember that you need to diversify - exchanges often scam and Closing of BTC-e To that vivid example. In a word, if you want to sleep peacefully, then the money should be scattered on several trading floors.

What are the best crypto currencies to trade?

There is already a decision for you only - there is a cloud of coins, they all dynamically change course and in the future can bring profit. If you visit any crypto-currency forum, you will realize that some investors buy only TOP coins, others - they hunt for novelties. Why is that? You can call it a kind of strategy, the calculation in which the terms of investment, the riskiness of the venture and the profit that can be obtained.

The fact is that with the growing popularity and price of a coin, it becomes less "mobile". For example, today it is no longer possible to expect that bitcoin can rise by 100% or 1000% per day - this is unrealistic. At the same time, "small" coins can jump hundreds and thousands of percent with ease, but unlike the giants of the market, they are more risky. The best option is to fill your investment portfolio with different coins designed for both long-term and quick profit.

How to trade on the exchange?

When you have decided on the choice of the exchange and decided which coins to give preference, the most important question is how the trade in crypto-currencies is going. If earlier you at least traded something, then you will not have any problems with the crypt - although this is a specific product, but the trade principles are everywhere the same. Beginners do not need to worry, then we'll tell you in detail how to mine your first commercial profit.

Analytical tools

The main principle of trade, whether you are selling pies on the market or crypto currency on the exchange, says - buy cheaper, sell more expensive. In the case of crypto currency, this rule is very easy to follow, because the coin rates are dynamic, they jump in different directions and you can easily dig into crypto symbols on the decline of the exchange rate. At the same time, I want to buy as cheaply as possible and get maximum fuel, how can I know where the price will go?

If trading with more stable goods - gold, oil, dollar - we can even find out from the news where the course will go, then the crypt is not so simple. While there are any news the market has already changed its trajectory ten times, and you just miss the profit. A successful trader should be able to independently analyze the market, and each exchange provides tools for this.

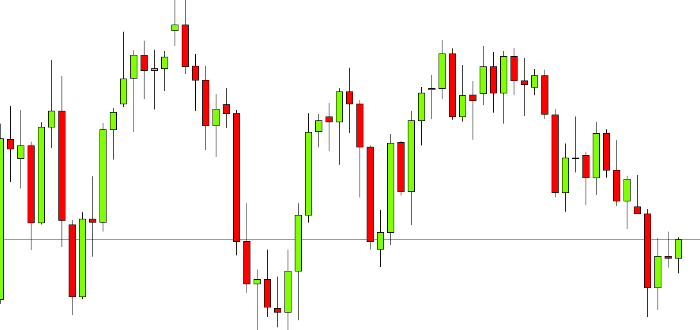

- Graphs - show how the price of a coin has changed over a certain period of time. Most often traders prefer candlestick charts as they are the most informative. What can you learn from the graph? What power prevails in the market (buyers or sellers), what is the current trend of price movement, what was the rate at the opening and closing of trades. All these nuances are indicative for understanding the state of the market and make it possible to determine the entry and exit points.

- A glass of bidding - First, it allows you to understand the difference between the current offers for buying and selling (spread), and secondly, it gives an opportunity to analyze where the price will go in the future. For example, if very large orders for the sale of coins appear in the glass (one large order or many small ones), then this is likely to unfold the course. Conversely, active or large purchase orders lead to an increase in the price.

- Trading history - if you know the volume of trade in a certain pair, then you can determine how much the direction of the particular exchange is popular. The claimed pair will actively recruit the course.

It is best to analyze the described tools in a complex. This increases the likelihood of a correct interpretation of the situation, which means that you will have time to jump in and out of the market before the trend changes.

It is important to understand that if you do not possess the gift of vangovage, then, with your finger pointed at the sky, you can not earn any money on speculations by crypto currency. You should be able to read analytical tools, understand market processes and, based on this, make a decision about buying or selling. Randomly in this area you can not earn money - this fact is verified by many enthusiasts who simply merged their bank, imagining themselves smarter than others.

Trading Instruments

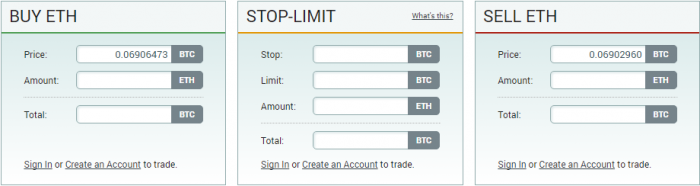

Another important nuance, which is not a hearsay, should be a sign of a trader-warrant. They represent the user's application for the operation. Standard, distinguish between two types of orders - BUY (purchase) and SELL (sale). They are quite suitable for simple operations of buying and selling, regardless of the market price or not. Not at all stock exchanges there is a stop-warrant and it is very vain - it very much helps to earn at the lowered risks.

Stop-limit - an order that is in a suspended state until a certain price is reached. Once the market reaches the specified rate, then the order is put up for sale, this allows you to get the maximum profit without the risk of losing the moment of exit from the market. It is this order that should become the main instrument of your trade.

Principles of trade in crypto currency

Exchange trade in crypto currency is a whole art that can not be mastered by reading a couple of articles. Most of the knowledge will come to you with experience, in the process of trading you will have your own strategy and principles of trading. Nevertheless, there are general rules that will help to achieve success in the speculation of the crypt:

- Never give in to panic. Once you are confused and sell coins that have gone into a drawdown, you will lose money. The market is very volatile and for a long distance most crypto currencies show stable growth - your task at any drawdown is just to keep calm and wait for your high point.

- Half of the money is in bitcoin. It is the basis of the market, the main means of payment and one of the most stable coins. Bitcoin will not only make diversification of funds more reliable, but at any time it can be changed to a promising coin.

- Leave some money in fiat. The market may collapse, and as practice shows, the drop of the cue ball drags along with the decrease in the cost of the violas. If you have a Fiat, you can buy coins cheaply during such crashes.

- Large amounts should not be stored on the exchange - if you have purchased for a long time, then take them to hardware or software purses.

- Do not be in the mood of a crowd. On the stock exchange, you should not follow mass hysteria and buy, if everyone buys - act on the contrary, because those who buy a coin will also start selling it actively, and this will roll the course.

- Do not try to guess - analyze. Do not think that analytical tools exist simply because they are an important help for a trader and should not be neglected. Consider dynamics at different intervals, observe different situations and predict entry and exit points.

Trading crypto-currency is a fantastic way to make money online. Of course, simply by reading the article, you will not become a genius of trade and will not earn a million on an equal footing. For this it is necessary not only to get acquainted with a large number of publications, but also to practice, develop their strategies and fill cones. If you manage to comprehend this skill, then you will have unlimited possibilities for obtaining a profit. Happy trading!

August 17, 2017

Make money

I WANT TO EARN 10000000 $ + 380682423640

Not an unambiguous article, one must understand!