SHARPE CAPITAL is a decentralized investment platform.

Sharpe Capit al Is a highly effective forecasting mechanism for funds and investors. The platform builds a decentralized ecosystem in order to help project participants and institutional investors better understand financial markets.

al Is a highly effective forecasting mechanism for funds and investors. The platform builds a decentralized ecosystem in order to help project participants and institutional investors better understand financial markets.

The project will analyze the opinion of the participants of the platform, on the basis of machine artificial intelligence, will be trained and, as a consequence, will trade, i.e. how to buy assets or sell them on time. In this case, the platform participants will receive remuneration for the correct answers. The more correct the data of the participants, the more Sharpe Platform Token (SHP) tokens they receive. The assets act on the Ethereum blockbuster platform. The Sharpe platform, supported by the release of SHP crypto-tokens, achieves this by developing models that cover the complex relationship between microeconomic data on the asset and its market value using the latest machine learning technology, as well as the ability to assess their own perceptions of current market behavior, Inclusion of two sources of analysis of participants' moods. The project is able to get a measure of participants' moods using a crowdsourcing system, evidence of a share and proof of reputation that rewards users for providing useful sentiments, payments for mood services will be changed to crypto currency.

Features characterizing the merits of Sharpe Capital

1. The concept of hybrid intelligence is machine learning, which provides an extremely effective forecasting of the benefits of certain investments;

2. The training of the intellect will depend on the opinions of the participants in the mobile application, which, in consequence, will receive ETH.

3. To reduce transaction costs and store information, Amazon Web Services is used through the AWS Lambda feature.

The main factor that makes Sharpe Capital's digital token sale unique compared to similar companies using last year's 'ICO' model that generate income, in part thanks to private investment activities, is the latest combination of off-chain and on-chain systems and architecture. redefining how capital funds should work. As a consequence, the power of blockchain applications lies in the lack of need for trust, provided by decentralization and the absence of "central authority". However, in order to truly leverage the power of blockchain and decentralization, startups must learn to combine their smart contract implementations with more traditional “off-chain” systems and applications.

To monetize your project, the team applies the appropriate methods:

—collection of the commission for managing the assets of its crypto-currency fund;

— the implementation of information that the system takes from exhibitors of its program, to large investors and funds;

— payment for the adoption of a unique information system;

- Consulting operation in the field of blockchain.

The main factor of this program is Sharpe Capital Fund, which in the first month of its work demonstrated 85% ROI (return on investment). In 1, five weeks of its work, Sharpe Capital reached 15 thousand assumptions on assets. The specific scheme of the roadmap and the technologies of the organization demonstrated an excellent indicator on return on invested capital. Approval of the applicability of the company's analytical result is the fact that the partner of the company became the famous blocking program ETHLend, which specializes in issuing online loans in the crypto currency. An important part of Sharpe Copital makes it possible to reduce the risk of investing and has every chance to become the main source of data on the market.

SHP tokens

It is planned to release tokens in the total volume of 400 million. Tokens Sharpe (SHP) platforms will be released based on 2000 SHP for 1 ETH.

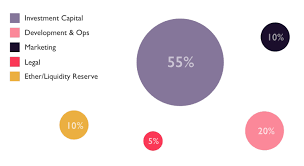

55% is the investment capital of the platform

20% - development

10% - marketing

5% - legalization

The team will release tokens using the Bancor network to provide instant SHP liquidity, without requiring the use of traditional exchange-based mechanisms. Currently, we are negotiating with the Bancor team, working to determine the optimal approach to determining the optimal value of the ratio of foreign exchange reserves, virtual reserves and permanent reserves, in order to achieve the ideal balance between liquidity and allowing the movement of the SHP price through the Bancor protocol.

The Bancor protocol provides the convertibility and built-in liquidity of tokens released through the Bancor Network, using a unique mechanism for detecting prices.

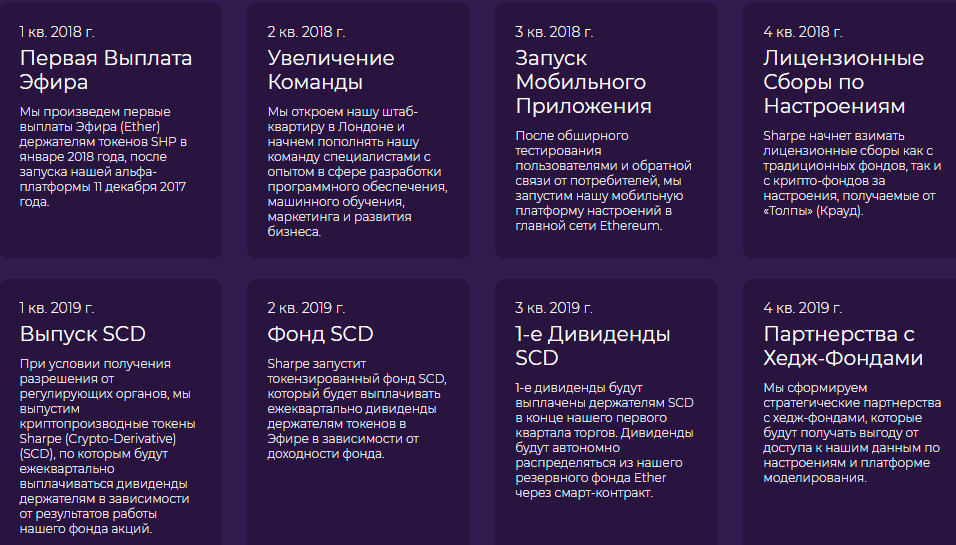

Roadmap

1kv. 2018 will be made the first payments Ether (Ether);

2kv. 2018goda increase in command staff. The headquarters will be opened in London.

3kv. 2018year launch of a mobile mood app on the main Ethereum network

4kv. 2018goda license fees on moods

1kv.2019goda release of crypto-tokens Sharpe (Crypto-Derivative) SCD.

2kv. 2019 is the SCD fund. Sharpe will launch a tokenized SCD fund, which will pay quarterly dividends to the holders of the tokens in the Ether

3kv. 2019year. The first dividends will be paid to holders of SCD

4kv. 2019year. Partnership with Hedge Funds.

Team

· Lewis M. Barber Chief Executive Officer Lewis graduated from the University of Leeds in 2011 with a BA in Engineering with Honors.

· Dr. James A. Butler Chief Investment Officer James graduated from the University with Lewis at 2011 and continued his studies to obtain Ph.D. in complex system modeling at the University of York in 2015.

· Israeli Colomer Chief Technology Officer Israel received a bachelor of engineering from the Polytechnic University of Valencia in 2007.

· Dan Pilch Cloud Architect and System Engineer Dan graduated from the University of Portsmouth with a bachelor's degree in computer networking engineering at 2013.

· Dimitrie Chuprina Entrepreneur and Investor Demetrius received a bachelor's degree in economics from the University of San Francisco. Dimitry is an expert in the field of business development and portfolio management. His interests are primarily focused on rapid growth technologies.

Dr. Mieke Vandenbrucke Counselor in Linguistic Analysis Meeke received a master's degree (with honors) in 2010 and a PhD in 2015 at the University of Ghent.

Dr. Herman Leonov Advisor on Quantitative Modeling Herman received a bachelor's degree (with honors) in 2011, and in 2015 he received a Ph.D. in integrated systems analysis at the University of York, where he is currently a postdoctoral researcher-researcher

references

WebSite: https://sharpe.capital/tokens

Twitter: https://twitter.com/sharpecapital

Telegram: https://t.me/sharpecapital

Facebook: https://www.facebook.com/sharpecapital

Bitcointalk: https://bitcointalk.org/index.php?topic=2139201.0

WhitePaper: https://s3-eu-west-1.amazonaws.com/sharpe-website/whitepaper_ru.pdf

* Our BTT account - https://bitcointalk.org/index.php?action=profile;u=1473358;sa=summa

January 23, 2018