Capitalization криптовалют - how much do virtual money cost?

Capitalization of crypto currency is a key topic in the news line Blockspace. One coin falls, the other shows an active growth in capitalization, but for many users it remains unclear what is this indicator and why should we all follow its dynamics. In this article, we will tell not only what the market capitalization of digital assets is, but also tell why the capitalization of most coins is a real fiction.

Market capitalization Crypto-currency

In the financial world, everything has its price, and since the crypto-currency market is an emerging sphere, much of it inherits from the already existing financial markets. And although at its core it is a very specific asset, nevertheless, in many respects, the crypt is compared with money, then with shares, and not having decided on what in the real world it looks like more. So, by analogy with the financial market, the crypto-currency sphere borrowed the method of capitalization accounting.

You probably heard that the shares of Apple or Microsoft are expensive and these corporations have a large capitalization? No one will doubt that these giants are estimated at several hundred billion dollars, but when it comes to the capitalization of bitcoin or etherium, then many people have different doubts. Nevertheless, the concept of "capitalization" for the market of crypto currency is applicable and plays a very important role.

What is the capitalization of a particular crypto currency? As in the case of company shares, in order to find out the value of the entire market, it is required to multiply the rate of the crypto currency by the number of existing coins. The resulting number represents the total value of a particular digital asset.

What does the capitalization of a crypto currency mean?

Capitalization of crypto-currencies is not an empty phrase, but an important indicator that indicates how much the coin is stable in the market and how interesting it is to the investor. If, for example, any scamcoyin does not inspire investors and nobody buys it, then the coin rate is approaching zero - even if its creators are striking billions of coins, then capitalization will not grow from it.

On the other hand, capitalization shows us how much the coin is volatile and how you can actively influence its course. It's not a secret that on exchanges, there are various frauds and manipulations with coins, as a result of which their initiators receive a profit. By merging large capitals, it is possible to cause a collapse of the crypto currency, and meanwhile, on the contrary, contribute to an active growth of the exchange rate. For coins with a large capitalization, such tricks are practically impossible - how, for example, can the rate of bitcoin, which has a multi-billion dollar capitalization, be collapsed? For this, huge funds are needed, so there will not be much "storm" for the main crypto currency. What can not be said about newly made, but popular coins with a small capitalization - for them even the mood of small traders play a role.

The rate of the currency and its capitalization

From all of the above, it becomes obvious that capitalization depends on two values - the rate of the currency and the number of coins issued. And since both the first and the second is not an indicator of a static one, capitalization is subject to constant fluctuations in different directions. Why is this happening?

We know that coins are born by of mining, that is, prey. But far from all of them arise exactly this way - it was only at the beginning of its emergence that crypto-currencies could not do without miners. The new coins are mostly started by holding ICO and then mining, as a rule, is not provided. Developers produce a certain amount of crypto currency, sell as much as they can, and extra coins are burned. In this case, we can safely say that one of the indicators in calculating the capitalization will be static. If, however, the currency is mined by miners and the number of available coins is continuously growing, this will affect the growth of capitalization.

As for the course, as we know, it directly depends on the confidence of investors who are ready to support the coin with a dollar, that is, they invest their money in it. And since the mood of buyers in the market can be the most windy, the coins are subject to noticeable fluctuations. The following factors influence the course of any of the Crypto-currencies:

- Crypto-currency news. Whether it's positive news or negative, they can have a strong impact on the price of digital money. Recall what was happening with bitcoin, when it became known that the planned SegWit2x and how the course soared after its cancellation.

- Legislative initiatives in respect of crypto-currency. The prohibition of crypto-instruments in China, regulation ICO or adoption of bitcoin as a national currency in individual countries - all this was reflected in the dynamics of the course.

- Behavior of "whales". Large capitals not only affect their large purchases or plums on the course, but also set the trend, which will be inherited by much smaller traders.

- Loud statements of politicians, billionaires and other respected personalities. If someone is fabulously wealthy and mega-experienced in earning money will say that there is a prospect in some crypto currency, then many will involuntarily start to look in her direction.

- Technological modernization of crypto-currencies. The developers of most coins do not throw them to the mercy of fate after the start, but continue to upgrade and refine already "on the go." Of course, if any of the coins are upgraded to the most anonymous or introduced the possibility of instant transactions, then interest among investors will awaken to it with renewed vigor.

Capitalization kriptovaljut - a rating of real cost or approximate values?

As it was said above, such a financial indicator as capitalization, the crypto industry borrowed from markets that existed a long time ago, but somewhat in a different formulation. If the capitalization of a company is calculated from the actual number of existing shares, then with the crypto currency, not everything is so transparent. In fact, the capitalization of many crypto-currencies, in particular Bitcoin, much lower than what popular and authoritative resources say about it.

How is this possible? The fact is that when calculating the capitalization, the number of coins issued is taken into account, whereas it is impossible for anyone to say whether they currently exist and whether they have access to them. For example, it is known that from 1 to 2 millions of bitcoins disappeared without a trace along with the person of Satoshi Nakamoto, who is considered missing. That no one knows with the cuebot maker and his coins, and in fact there is a possibility that this colossal amount can be lost forever, like himself the creator of crypto currency. In parallel with this, in the hours when bitcoin was not worth anything, the miners threw away their burnt PCs along with coins on hard disks. These bitcoins are also completely lost and can not be restored, which means that they are not included in the capitalization and should not be taken into account.

Many skeptics say that it is incorrect to consider the capitalization of the crypto currency, because it is not a stock of any company, but a prototype of money. In a word, not everything is clear with the purity of the calculation of capitalization, but it seems that nobody cares about this issue - everyone is in full euphoria from the opportunities that crypto money gives.

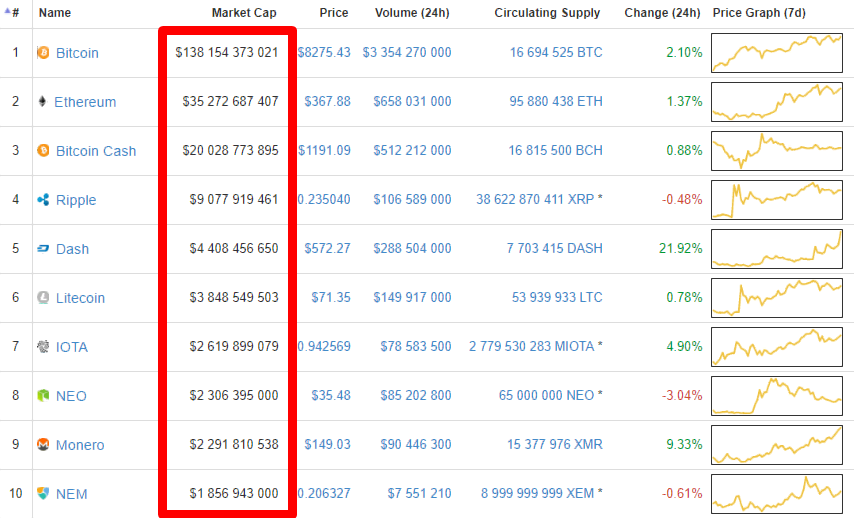

TOP CROP on the capitalization

If somewhere they say about the rating of the crypto currency, then in mind have just the same capitalization - it is this parameter that most accurately displays the value of the coin. And as the capitalization can change, then the list of these promising and worthwhile coins can be transformed. Nevertheless, recently the TOP is still quite stable, about the top of the rating and we'll talk further.

- Bitcoin - capitalization of 138,1$ billion The main crypto currency is the basis of all cryptology - it is the cue-ball is the main investment tool, it is in them that they are the most traded and it is with bitcoin that most of the trading pairs. Over other crypto currency, bitcoin dominates in its capitalization and is 56,3% of the total market.

- Ethereum - one of the most promising crypto currency, because it is an innovative platform that operates on smart contracts. Unlike bitcoin, the creator of the ether did not disappear anywhere and did not take millions of coins with him. Vitalik Buterin is working hard on the project, and therefore the total cost of the entire broadcast exceeded the indicator in 35$ billion

- Bitcoin Cash - Fork bitcoin was distributed to everyone free of charge, and if this fact is supplemented with solid developer's capital that actively supports the coin rate, it becomes clear how the new crypto currency could be on the third place in terms of capitalization. The total cost of bitcoin cache is 20$ billion

- Ripple - Not exactly crypto-currency, in the traditional sense, it is the fourth in terms of capitalization and is actively introduced into the work of offline banks. Many say that the coin is waiting for a great future, but while its capitalization is at the level of 9$ billion

- Dash - a cryptocurrency with an increased level of anonymity ranks fifth in the rating with a capitalization indicator of $ 4,4 billion. At the time of this writing, Dash has shown an active growth in its rate and has risen in price by almost 22%.

- Litecoin - Another fork bitcoin, but less scandalous than bitcoin cache. The coin boasts a strong team of developers who will upgrade it as soon as they can, but on the whole it does not differ much from the cue ball. Capitalization of lightcoin - 3,8$ billion

Crypto currency is huge, but not all of them have any significance in terms of their capitalization. Out of over a thousand coins, only 13 can boast that their total turnover is more than 1$ billion and less 70-ti by capitalization have at least 100$ Million

Why is it necessary to know the capitalization of a crypto currency to an investor?

The answer to this question is obvious - it is capitalization that tells the investor which coin is worth paying attention to. Since high-capitalized crypto-currencies are less volatile and show stable growth at a distance, they should be chosen for long-term investment. They will work for the future, and you will not have time to look back, just after the second year, the bitcoin in your portfolio will grow by several hundred percent.

In the same case, if you need a more volatile asset that can multiply by several hundred percent in a week or a month, then you should pay attention to coins with less significant capitalization. As a rule, they storm in different directions and on these races you can get a daily profit.

Capitalization криптовалют is though and not absolutely exact, but rather important parameter of the importance of a coin. Be sure to consider the market value of the asset when investing or trading - this will help you predict how much digital cash is subject to fluctuations in the exchange rate and in general will reflect the level of confidence of users in the crypto currency.

22 November, 2017